Helio Provides Tanzania Update

Helio Resource Corp. (“Helio” or the “Company”; TSX-V: HRC) hereby provides an update of the SMP Gold Project located in Tanzania.

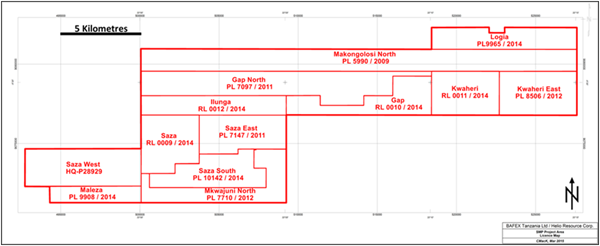

Helio’s SMP project comprises 8 Prospecting Licenses (PLs), 4 Retention Licences (RLs), and one licence under application (see map below). The four Retention Licences are RL 0009 (Saza), RL 0010 (Gap), RL 0011 (Kwaheri), and RL 0012 (Illunga). Under the Tanzanian Mining Act, 2010, Retention Licences were issued to projects at which a mineral resource had been identified, but the projects could not be developed to mine status by reason of technical constraints, or other economic factors which are temporary in nature.

Changes to the Mining Act 2010 were announced by the Tanzanian government in June 2017, and have resulted in the Retention Licence classification being abolished and ownership transferred to the government. The Company has been assured verbally by government officials that the Tanzanian government will not expropriate the ground covered by the Retention Licences and wants to work with the Retention Licence holders to ensure that projects are advanced to the point where a mining licence can be applied for.

The Tanzanian government has formed a Mining Commission which will make recommendations for the way forward with regards to the ground covered by Retention Licences. After consultation with ministers from the Ministry of Minerals, Helio has applied for the ground covered by the Retention Licences to be re-issued as Prospecting licences to allow the project to be advanced. However, the Commission has yet to make any recommendations or any commitment as to a date by which its recommendations will be made.

About the SMP Gold Project

The SMP Gold Project covers a 200km2 area in the Lupa Goldfields, SW Tanzania and is adjacent to the New Luika Gold Mine, operated by Shanta Gold Limited, an AIM-listed company. On March 26, 2015, Helio released a mineral resource estimate for the SMP Gold Project, comprising an Indicated Resource of 7.5 MT grading 2.4 g/t Au for 590,000 oz Au contained, and an Inferred Resource of 0.56 Mt at 2.5 g/t Au containing 45,000 oz Au. The Indicated Resource is broken down into 5.9 Mt grading 1.8 g/t Au for 332,000 oz inside a pit-constrained shell at a gold price of US$1,400/oz and 1.6 Mt grading 4.9 g/t for 258,000 ounces of potentially underground mineable material. A NI 43-101 Technical Report for the Mineral Resource Estimate can be viewed here - click here for full details.

Richard Williams, M.Sc., P.Geo., Helio’s CEO and a Qualified Person as designated by NI 43-101, has reviewed and approved the contents of this news release.

For further information please contact Richard Williams at +1 604 210 8753.

ON BEHALF OF THE BOARD OF DIRECTORS

“Richard D. Williams”

Richard D. Williams, P.Geo, CEO & President

Map of the SMP Gold Project

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Statements Regarding Forward-Looking Information

Certain statements contained in this news release may contain forward-looking information within the meaning of Canadian securities laws. Such forward-looking information is identified by words such as “anticipated”, “estimates”, “intends”, “expected”, “believes”, “may”, “will” and include, without limitation, statements regarding the company’s plan of business operations (including plans for progressing assets), estimates regarding mineral resources, projections regarding mineralization and projected expenditures. There can be no assurance that such statements will prove to be accurate; actual results and future events could differ materially from such statements. Factors that could cause actual results to differ materially include, among others, metal prices, risks inherent in the mining industry, financing risks, labour risks, uncertainty of mineral resource estimates, equipment and supply risks, title disputes, regulatory risks and environmental concerns. Most of these factors are outside the control of the company. Investors are cautioned not to put undue reliance on forward-looking information. Except as otherwise required by applicable securities statutes or regulation, the company expressly disclaims any intent or obligation to update publicly forward-looking information, whether as a result of new information, future events or otherwise.